Published by AstroAwani & BusinessToday, image by AstroAwani.

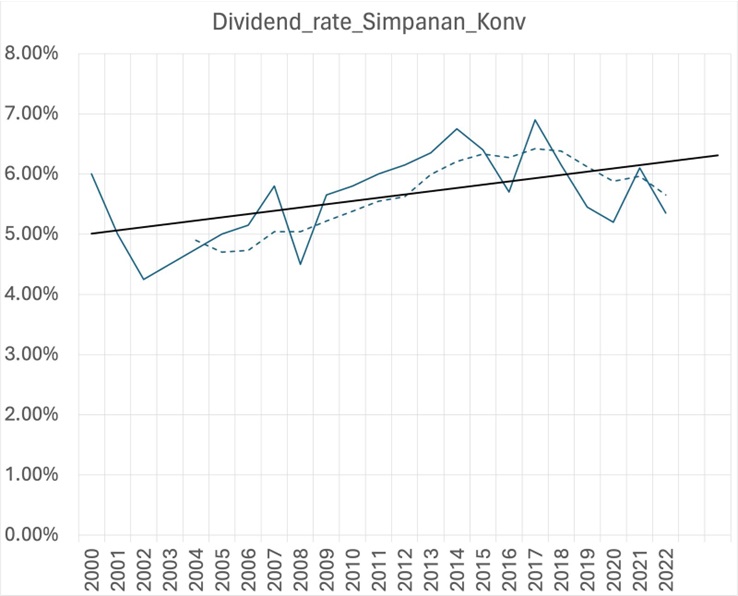

On the optimistic side, EPF’s expected dividend declaration for financial year (FY) 2023 could range between 5.7% to 6.7% – higher than the 5.35% in 2022. Narrowing the range, a ballpark figure could be 5.95% or 6.15% (based on historical trend estimates – see Chart 1).

Chart 1

Experts are forecasting EPF paying out the highest ever dividend, i.e., at RM60 billion (and above), which surpasses the current record-high of RM56.72 billion for 2021 (“Experts say EPF’s total dividend payout may be highest ever”, Business Times, January 4, 2024).

EPF’s investment performance for the first nine months of 2023 alone saw RM47.86 billion in cumulative income, representing an increase of 33% compared to the RM36.04 billion recorded in the same period in 2022 (see, “EPF records RM47.86 billion total investment income for 9m 2023”, EPF Media Desk, Corporate Affairs Department, EPF, November 16, 2023).

Furthermore, under the Madani/unity government, no more special or “one-off” EPF withdrawals are permitted – which should allow for the conservation of the assets allocated for investment. By extension, this allows for a higher dividend and payout (ringgit as investment for ringgit as return).

EPF has maintained an average annual fund ratio of over 80% for investments in the domestic market from 2019 to 2023.

The buoyant expectation also comes at a time of positive real interest rates in the second half (2H) of FY 2023, i.e., where inflation (trending below 3%) is now lower than the official and market interest rates.

Contrast this with foreign destinations such as the UK – which comprises approximately half of EPF’s overseas assets under management (AUM) – where negative real interest rates persisted for longer (vindicating the Prime Minister’s clarion call last year for repatriation and re-balancing towards domestic investments) combined with downward pressure on the exchange rate.

EPF’s total assets are reported to stand at RM1.1 trillion as of September 2023 (2H FY 2023) – of which 62.3% represented domestic investments whilst 37.7% were overseas. The ratio is expected to widen in line with the Prime Minister’s call and vision for EPF to increase and enhance its domestic investments to 70% in the coming years.

EPF’s financial performance for the first three quarters of FY 2023 is expected to have been sustained in the fourth quarter (Q4), especially on the back of the equity market as listed companies continue with the momentum of recovery amidst the challenging external backdrop of geo-political and geo-economic dynamics such as the on-going conflict in Ukraine with lagged supply-chain implications and the interest rate hikes in the US.

The federal funds rate (FFR) hikes were meant as counter-measure to the USD volatility and inflationary pressures – thought also to emanate, to an extent, from expansion of the money supply. What’s clear/definitive is that the NAIRU (non-accelerating inflation rate of unemployment) hypothesis where there’s a trade-off between employment and inflation has been debunked (as anticipated in EMIR Research article, “Interest rate hikes lands the poor further into poverty”, October 4, 2022).

Instead, demand in the US is a consequent factor resulting from higher wages, anticipatory pricing by employers, expansion in money supply due to increase in borrowings, and not least sellers’ inflation aka “greedflation” – in response to the antecedent cause of inflation, i.e., supply-chain shocks/disruptions.

Although equities contribute less at 42% compared to fixed-income at 47% in the assets invested for Q3 FY 2023 which is a 5% difference, the former yielded a return of 63% compared to the 32% by the latter, representing a 31% difference or nearly twice the amount. This is six times (6x) higher than the difference in the percentage invested.

According to a report by RHB Research (December 15, 2023), the “improved performance of some of the stocks on Bursa Malaysia in the second half of 2023 was driven by sectors such as power, construction and properties” (“Market Recap: Bursa Malaysia’s biggest winners and losers in 2023”, The Edge Markets, January 4, 2024) of which EPF holds a significant share, overall.

For example, EPF owns 15.63% of shares in power utility monopoly company TNB (“EPF purchases 0.17% stake in TNB for RM98 mil”, The Edge Markets, September 8, 2023).

In terms of the construction and property sector, EPF owns 36.21% (as of 2020) of MRCB (Malaysian Resources Corporation Bhd).

It also owns 65.87% in the Malaysia Building Society Berhad (MBSB) and 41.94% in RHB Bank Bhd. Bank Negara’s Overnight Policy Rate (OPR) hikes – which peaked at 3.00% – have provided some breathing space from the compression pressure vis-à-vis the net interest margin (NIM) for the banking sector. Banks’ share price enjoyed strong buying support in the earlier second half of the year (2H FY 2023) – but admittedly they became somewhat subdued as can be seen in the sell off towards the latter 2H FY 2023.

In EMIR Research article, “EPF in a low interest rate environment” (February 24, 2022), it’s highlighted that EPF’s then expected dividend declaration (conventional) for FY 2021 of about 5.2% to 6% was “… set against the wider backdrop of a generally low interest rate environment globally …”. It’s argued that “… there’s simply no correlation between higher returns and higher rate of interest at all (when considering investment decisions)”.

As such, the correlation between higher returns would be other than the level of the interest rate, which can only be referred to EPF’s prudential judgment and assessment of its investment strategies and practices as embodied in the Strategic Asset Allocation (SAA) framework and decision-making algorithm (which are reviewed and if need be adjusted once every three years, taking into account prevailing market conditions and evolving dynamics such as changes to (a) regulatory requirements, (b) accounting policies and practices, (c) institutional constraints, etc.).

According to EPF Chief Investment Officer (CIO) Rohaya Mohammad Yusof, the SAA aims at optimising long-term investment returns within tolerable risk limits.

She added that, “[e]ach asset class plays a role in ensuring that … EPF delivers on its investment objectives, with [f]ixed [i]ncome [i]nstruments anchoring the overall [portfolios] and preserving members’ savings by providing a stable stream of income via interest payments”.

The “low-risk” (profile – as EPF’s own preferred term) or “risk-free” nature of sovereign debt means that the movement of interest rates as manipulated by the central bank in representing the benchmark rate across the term maturity spectrum in the financial markets doesn’t alter or affect the role that fixed income play as anchor of the overall investment assets.

Whereas “[e]quities enhance returns for the portfolio by adding value to members’ savings with returns that surpass the inflation rate. Real estate and [i]nfrastructure assets serve as a hedge against inflation by providing rental income and capital appreciation”.

The money market funds (MMFs) serve to cater “for … EPF’s day-to-day operations such as investments, withdrawals, and operational expenses”.

Under its SAA for 2023, EPF earmarked RM97 billion or 83% of its annual total fund allocation for domestic investments.

The OPR hikes would have led to higher interest income payments to EPF (albeit under conditions of a worryingly higher debt service charge/DSC of 15.9% or RM46.1 billion, as of 2023) – as the single main holder of the Malaysian Government Securities (MGS) bonds (at 24.2% as end of September 2022) – for each tranche of fresh issuance. At the same time, EPF was able to capitalise on the decline of benchmark yields (which is inversely related to the bond price), e.g., in Q1 FY 2023, when off-loading (pre-existing issues) on the secondary market.

In the US, increase in interest payments represents indirect deficit spending by the federal government (Treasury) as the income received is injected into the economy by the federal (e.g., Social Security, Medicare) and state agencies – double deficit spending in the lending and redemption. This explains why the increase in the federal funds rate (FFR) has hardly resulted in a deflationary impact that’s consistent with rising unemployment (NAIRU debunked). Those who were bent on a hard-landing didn’t get their wish unless the Fed does a Paul Volcker, whereas there’s no certainty that a soft-landing compatible with a 2% target inflation rate is realistically achievable.

EPF isn’t in a position to simulate a similar role in deficit spending via the (bond) interest payments received together with the principal redemption which would be partially re-invested for the refinancing or roll-over of existing sovereign debt (RM135.3 billion for principal repayments by the Ministry of Finance/MOF), especially where the balance is now towards long(er) term bonds, i.e., MGS and GII (versus short-term, i.e., Malaysian Treasury Bills/MTBs).

On the other side of the fiscal policy equation, refinancing in coordination with MOF is a critical strategy by EPF to ensure that its asset class in fixed-income security (under the SAA) remains the overall anchor – even as the government embarks on fiscal consolidation under the Medium-Term Fiscal Framework (MTFF).

According to MOF, “[The government] aims to manage refinancing risk by reducing the issuance of short-term papers and increasing the issuance of medium- and long-term instruments as the pricing spread between the maturities narrowed” (p. 138, Section 4 – Debt Management, Fiscal Outlook 2024, MOF).

But EPF plays a crucial and pivotal role in the equity market with its direct and indirect ownership of listed companies, including government-linked companies (GLCs). By extension, EPF is well-poised to stimulate the economy directly in the form of secondary and indirect fiscal injection through, e.g., the bank loans for EPF-owned companies that’re initially created as deposits operating under the legal framework of monetary policy of the central bank and, by ultimate extension, the government.

The Prime Minister’s vision for greater domestic investments by the EPF (see, EMIR Research article, “The PM’s call to EPF to increase its domestic investments”, May 12, 2023) augurs well for the latter’s role in indirect fiscal injection complementing and supplementing the government’s deficit spending (e.g., Budget 2024). It’ll also provide greater scope for increased corporate tax revenue (intake) to counter-balance the move towards fiscal consolidation.

At the same time, the government could seek to widen the tax base as regards capital gains tax (CGT) on listed companies (with the possibility of excluding ACE and LEAP companies or companies that’re ten years and below, for example) to equalise the fiscal space with non-listed companies with either the same charge of 10% or slightly higher at between 12% to 15% or otherwise introduce a tiered or progressive structure in lieu of a flat rate.

However, EPF shares in both non-listed and listed companies should be permanently exempted from CGT together with foreign-sourced income (FSI) as are the dividends for unit trusts (exemption on CGT is effective from January 1, 2024 to December 31, 2028 whilst exemption on FSI is from January 1, 2024 until December 31, 2026) as announced by former CEO of EPF and now Finance Minister II Datuk Seri Amir Hamzah Azizan only recently (“Govt exempts CGT, FSI taxes on unit trusts”, The Star, January 16, 2024).

Additionally, the government should strongly consider introducing a tiered and progressive taxation structure for mid-tier companies (MTCs) and large local companies (LLCs) and multinational companies (MNCs). Again, this is to create a more level fiscal playing field with the small and medium-sized enterprises (SMEs). It’d also counter-balance the reduction in corporate tax for the same category of companies (i.e., the former) as part of the ongoing effort to increase our domestic competitiveness alongside continuously enhancing our attraction as a foreign direct investment (FDI) destination and in line with the move towards a global minimum tax (GMT) of 15%.

Lastly, it’s urged that EPF seriously consider adopting and integrating the Input-Output-Outcome-Impact (IOOI) framework (which EMIR Research has been advocating) into its SAA.Jason Loh Seong Wei is Head of Social, Law & Human Rights at EMIR Research, an independent think tank focussed on strategic policy recommendations based on rigorous research.