Published by BusinessToday & MYsinchew, image by BusinessToday.

Communications and Digital Minister Fahmi Fadzil mentioned that the cabinet made several decisions regarding the rollout of 5G in Malaysia in a press conference on May 2, 2023.

The key point is that the decision was made to move away from the proven failure of a Single Wholesale Network (SWN) to a more diversified and credible way of deploying a new-generation framework. EMIR Research firmly believes this is generally a step in the right direction! However, the devil is in the details (or the lack thereof).

According to the official communication, the transition from SWN to a Dual Wholesale Network (DWN) is to proceed in two phases:

- Phase 1: 5G deployment to be continued by Digital Nasional Berhad (DNB) of up to 80% coverage of populated areas (CoPA) by the end of 2023.

- Phase 2: To start shifting to the DWN by early 2023 following global standards, which is expected to end the DNB’s monopoly and the shift is meant to manifest inclusivity.

Fahmi said the decision resulted from a joint task force between his ministry (KKD) and the ministry of finance (MoF) to ensure a smooth rollout without affecting investor interests. Specifically, DNB will continue to function with some mobile network operators (MNOs or telcos) taking equity in DNB.

Notably, the nature of the makeup of the new entity was not mentioned. Although, it appears that the government is to maintain its golden share in DNB, perhaps, at least to the end of phase 1.

More interestingly, Fahmi said there is no equity uptake in DNB yet (even though earlier DNB was trying to convince the public otherwise) but expects this to change upon this new development. It was reported last year that CelcomDigi Bhd (through its wholly owned subsidiaries) agreed to collectively take up a 65% stake in DNB alongside YTL Communications Sdn Bhd and Telekom Malaysia Bhd.

EMIR Research believes that the same key objectives — 80% of CoPA by the end of 2023 (as by phase 1) and competitive 5G rollout going forward in line with the global best practices (as by phase 2) — can be achieved more efficiently and effectively if the government immediately divests its share in DNB allowing the complete takeover of DNB by the major Malaysian Mobile Network operators (MNOs).

Moreso, in their current formulation, phase 1 and phase 2 sound awkward and, more importantly, open a wide door for sabotage of the current administration’s best intentions by the interested Malaysian super politico-corporate elites and neo-colonialists who have been holding (with a firm grip) Malaysia’s 5G rollout initiative as a hostage to their gains at the expense of the nation, at least, for the last four years.

Under the current setup, why would the MNOs want to keep equity in DNB?

Therefore, the completely unsurprising recent move by CelcomDigi to pull out from this deal might be followed by other MNOs.

Relatedly, Fahmi noted that all major MNOs had signed the access agreement except for Maxis Bhd. But this doesn’t necessarily mean they will be part of Phase 1. If anything, it could be more enticing for them to join the second network as of phase 2. After all, as it is well documented in the public domain, Maxis and U Mobile did not agree to the equity uptake in DNB in the first place but have been rather continuously coerced into it.

If major MNOs pull out of the equity deal and DNB is again on its own to complete the CoPA, this raises several serious considerations.

It took over two years to reach the current reported CoPA of 57.8%. How another 22% (roughly 2000 sites) can be completed in about half a year is unclear.

EMIR Research has already emphasised numerous times (e.g. refer to “Malaysian 5G Rollout: Credible Way Forward”) that this would not be a worry if MNOs are allowed to jointly (equal share participation) take over DNB’s assets 100%, including the spectrum.

In this case, MNOs could complete CoPA well before the end of 2023 by leveraging the existing asset base (e.g. sites, fibre), expertise and partner ecosystems while driving down deployment costs and improving affordability to Rakyat. After all, the major MNOs jointly own about 40000 sites with the existing 4G layer, which DNB builds anew and therefore duplicates costs (refer to “Malaysian 5G Rollout: Camouflaged Costing Acrobatics”). Compare this against the eventual 7000 by DNB.

On top of it, MNOs only need to tweak the software at their base stations to enable 5G.

But, all these talks about rushing the CoPA target miss a crucial point — it is not the most important key performance indicator (KPI) of the 5G rollout. It matters not if the rollout is at 50% or if the adoption is at 1%. Given these circumstances, does it even make sense to rush 80% CoPA?

And here, again, if MNOs pull out of equity participation and DNB is (or will be) having cash flow problems due to poor uptake of equity and/or financing by financial institutions and other investors, they have to look elsewhere for capital, such as raising sukuk/bonds against projected (assumed) future cash flows from the exclusive use of spectrum (DNB’s pure rent-seeking business model), which, will have to be backed by government guarantees for it to be bought by investors.

However, an absolutely abysmal 5G adoption (1% as reported by Global System for Mobile Communications Association or GSMA) despite already significant 5G coverage achieved by DNB and 5G services made available to the customers for almost half a year places serious doubt whether these cashflows will ever materialise (and also potentially points to already accumulated huge losses), exposing the government (the people) to yet another monetary burden. After all, the serious flaw of DNB’s so-called “supply-driven” model has been clearly seen since the very beginning, given the specifics of the 5G technology.

However, in the case of 100% joint takeover of the DNB’s assets by the MNOs government would be immediately relieved of the above significant financial burden.

There is another crucial aspect of a successful transition from a contentious SWN model to a competitive 5G rollout in line with the best global practices—certainty around the spectrum.

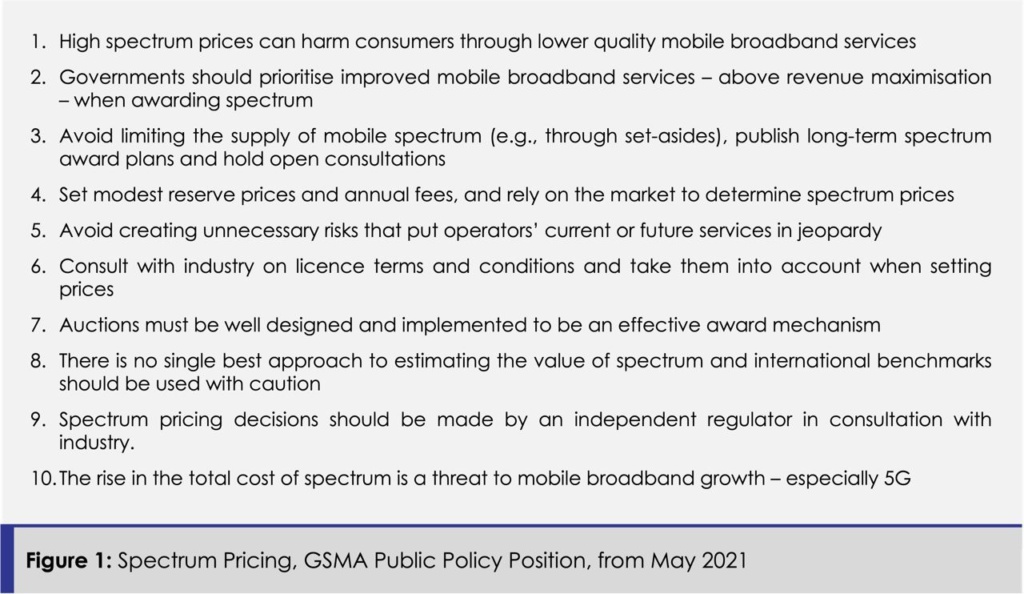

As global experience strongly indicates (refer to “Spectrum Pricing, GSMA Public Policy Position” from May 2021), sufficient spectrum availability at affordable prices to MNOs coupled with the solid national spectrum roadmap is the cornerstone of the successful rollout for successive networks. Such policies provide certainty around the spectrum and encourage investment by national MNOs into newer technologies in pace with innovation.

However, as we all witnessed, the sad DNB saga unfolding over the last four years has grossly violated all these fundamental principles (see Figure 1). Figure 1 summarises ten fundamental principles of a successful spectrum policy based on global experience.

Therefore, under the complete takeover of DNB by MNOs with the immediate concurrent conversion of spectrum in DNB, i.e., 700Mhz and 3500Mhz to Spectrum Assignment to MNOs will provide MNOs stability of operations and encourage them to immediately start deploying competitive networks, whilst providing additional monies to government coffers.

This does not mean that existing contracts with Ericsson must be terminated, as MNOs will know what to do with DNB’s assets (built and yet to be built)—MNOs would undoubtedly use them to cooperate in some areas where infrastructure-based competition does not make sense. However, in other areas, they may immediately start deploying competitive networks to beef up the resilience of our national network and tap into the global 5G innovation pool resulting in competition based on quality and price to benefit all Malaysians.

Last, the recent announcement assumes a transition to a “dual wholesale network”.

In this regard, we should not forget a painful SWN experience in Mexico (refer to “Single Wholesale Network: Global Experience” for details) where Mexican SWN by multinational consortium Altán Redes was allowed to operate alongside the private networks by Mexican MNOs. As a result (and as expected), SWN could not compete with the MNOs and filed for bankruptcy in the mid of 2021, only to be bailed out by the Mexican government by the end-2022.

Therefore, under the scenario of DWN, it is reasonable to expect DNB’s failure to leave Malaysia again with SWN. This should not be allowed. Malaysia has no more room for inefficient use of resources.

This is why since day one of the Malaysian 5G rollout debate, EMIR Research has advocated the successful model of Multiple Wholesale Networks (MWN) globally!

The policy shift from a monopoly to competitive model by the present administration consistent with its no monopoly stand is indeed laudable that will benefit the MANY. Emir Research has been consistent to champion the successful competitive model since the 5G voyage started in Malaysia navigating through all relevant and pertinent factors of a successful 5G roll out drawing from global wisdom.

Congruently, with these suggestions and important details above, Malaysia too can ensure effective and efficient transition and also will close the door for a potential policy reversal by neo-colonialists, both foreign and local, hell bent on advancing their “vested interests” to the detriment of our nation and people.

Dr Rais Hussin is the president and chief executive officer of EMIR Research, a think tank focused on strategic policy recommendations based on rigorous research.