Published in Astro Awani, image by Astro Awani.

Recently, Russia’s officials announced a series of crucial decisions to defend their economy. And the true significance of these events is the important underlying message to other nations, which goes deeper than mere speculation on how immediate the petrodollar and subsequent dollar collapse may be.

Although the European Union (EU) and their other allies are still in the denial phase of the grief cycle by Kübler-Ross, they hardly have an alternative other than accepting the proposal, given their high dependency on Russian natural gas.

According to 2020 data from BP and Energy Information Administration reports, from 20% to 23.3% of the World’s total proven natural gas reserves are in Russia—the single largest reserve. The second-largest reserve belongs to Iran—another country badly hurt by the West’s “hellish sanctions”.

According to the same reports, 37.5% of European natural gas imports come from Russia. Also, among the European countries, Germany is the largest consumer of natural gas and the most dependent on its Russian source (55% of its total imports). Therefore, interruptions to natural gas supply will hurt this economy the most. Moreover, because Germany is the largest and strongest economy underpropping the stability of the entire EU, the impact on the EU (and Euro) can be profound.

So, it appears that, for once, Anglo-Saxons got into their own “globalisation” trap of “competitive advantage”, giving the “resource curse” new meaning. It is close to impossible to say “no” to Russia’s proposal, at least in the short- to medium-term and even in the long-term, unless at the expense of paying near two folds higher prices for liquified natural gas and, as a result, losing its competitiveness to countries like China and India. The further strengthening of these Asian economies is not in US interests too.

However, this is a self-made disaster—the West practically did not leave a choice for Russia by effectively blocking it from using US currency. Notably, part of the sanctions measures was “freezing” (read simply “writing off”) around 300 billion dollars worth of Russian foreign exchange reserves. Russia’s officials defined this act by the West as a “default on their financial obligations”.

A currency is indeed an obligation by its issuer to redeem it for something of value later—ideally, the issuer’s own produce! In other words, the ability to issue currency should be arrested by the issuers’ ability to produce things of value. Otherwise, the default on this “obligation” with the ensuing financial turmoil for more than just the issuer alone is inevitable.

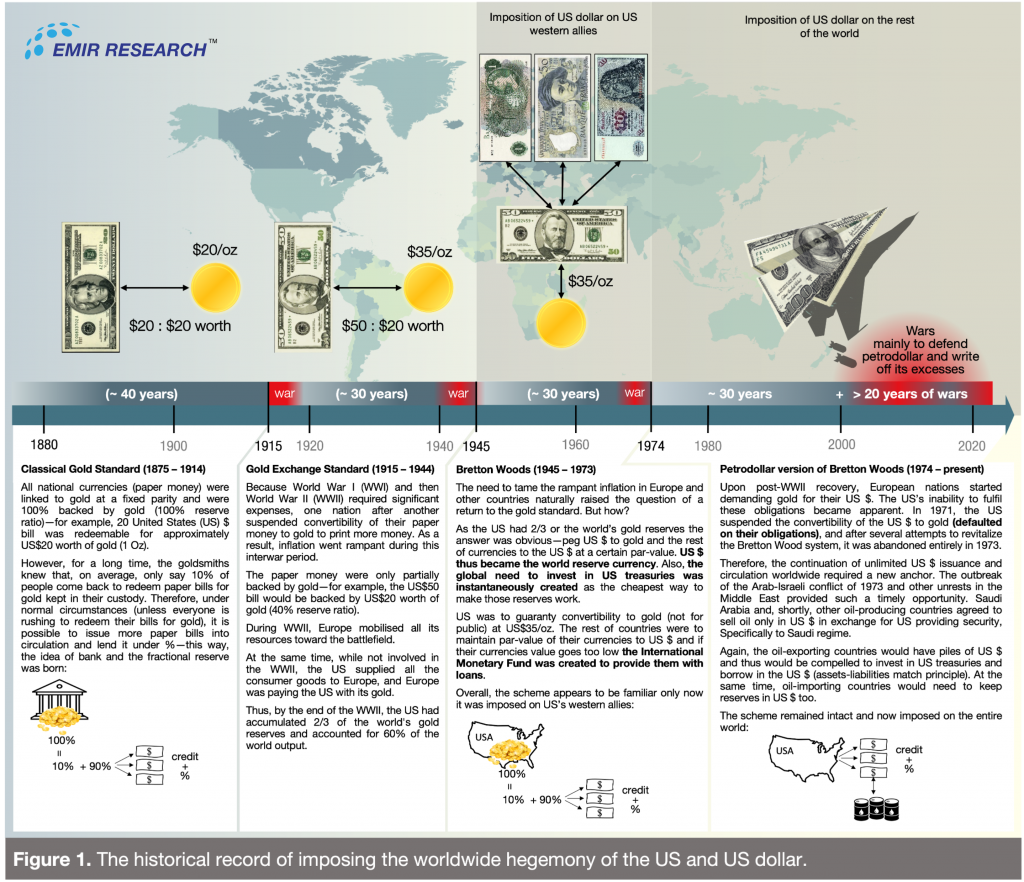

However, history records (Figure 1) how the United States (US) have continuously defeated this fair and vital law of real value exchange for near a century and expanded its currency issuance astronomically beyond its actual worth by using wars as a tool and thus continuously undermining the world’s stability in terms of inter-national cohesion and financial soundness. And history already documents how the US has been “writing off” its financial obligations when needed—wars always help write things off, so do the “sanctions”.

Note in Figure 1 how US ballooning credit creation is sustained by the US dollar expansion worldwide. We know that credit creation can be maintained only by more credit creation and as credit creation (read the US dollar expansion) slows down, the system is bound to catastrophic default. Therefore, instating mechanisms that guarantee gradual departure from this system before the meltdown should be on the national and international agenda.

Russia already has learned the hard way how devastating it is to keep hard-earned (through the creation of real value) capital in the form of US government bonds and currencies long ripe for partial write-offs and, by the association, in other US allies’ currencies such as the Euro, Pound, Japanese Yen.

Other nations should undoubtedly take the hint because they may not know when and how their national interests might conflict with the world’s hegemon, and it is better to prepare in advance. Other countries, including Malaysia, need to quickly re-evaluate how disproportionally reliant their foreign reserves and local and international trade mechanisms are on toxic Western currencies and credit system.

Notably, Russia has also indicated that this forced measure of selling natural gas in rubbles is just a “start”. Therefore, we should expect to see other highly demanded worldwide commodities largely produced by Russia, such as crude oil, wheat, fertilisers, metallurgical products, wood etc., to be traded in Russian rubbles soon.

As a result of these forced defensive measures, Russia achieves the following:

- The revenue from its exports will now stay in Russia to promote its economy and Industry 4.0 (4IR). 4IR is no longer monopolised like previous industrial revolutions, provided the country has been taking active steps to prop its 4IR sovereignty. Also, 4IR perfectly serves self-sufficiency at any scale.

- The countries importing from Russia will have to keep Russian Rubbles in their reserves, thus creating demand for it.

- The importing countries will also have to hedge the Rubble risks now and, therefore, be less interested in launching speculative attacks on it.

- The Russian Central Bank recently setting the floor price for gold purchase in Rubbles is another good defence tactic against potential currency attacks in the absence of US $ in your foreign reserves but the abundant presence of Rubble reserves due to export trades in Rubbles.

- The need to accumulate foreign reserves to ensure vital imports is weakened as the local currency can be used to acquire the resources and goods that Russia needs from its importers (mutual “financial obligations” clearance, in essence).

Other countries should and certainly will take note of the above benefits too, and the moves in this trajectory already transpire among the largest world economies.

The Federation of Indian Export Organizations president, Sakthivel, reportedly has said that western “sanctions” allow the Indian exporters to expand into Russian markets beyond predominantly agriculture and pharmacy products. Both countries certainly welcome this dynamic.

In line with this sentiment, in a meeting with his Russian counterpart on March 30, 2022, the Chines foreign minister is quoted as saying that “the will of both sides to develop bilateral relations has become even stronger”—as strong as “ironclad”. Moreover, China itself has been long expanding the use of its currency in trade settlements with its major trade partners. As of the most recent, China is at the tail end of securing such an arrangement for Saudi Arabia’s oil.

In other words, we observe a monumental shift gaining significant momentum from the unipolar world with artificially imposed dominance of western currencies and, by extension, rigidly centralised political and economic power (thus defending the interests of a handful of nations) to a more democratic, natural, balanced and fairer multipolar world with financial settlements in all sorts of national currencies, backed by the things of real value (natural resources or produce), based on mutually beneficial cooperation and respect for national sovereignties.

The world is finally an inch away from recognising a simple truth—money is simply information about the value by which (not for which) things of real value are exchanged! The moment we replace “by which” with “for which” (whether it is the US dollar, gold or other currency or commodity), the question arises—who controls its emission?

Therefore, eventually, fair international trade should be organised in the form of multilateral credit clearance, which may require a sort of synthetic settlement world currency calculated based on the weight of countries’ exports, their currencies, stock indices of oil, gas, metal, minerals, staple grains, and even water.

Restoring such mechanisms of fair exchange of real value on the global scale is a common interest for all countries, especially when the world has not even started recovering from the pandemic is dangerously dancing on the verge of World War III and global famine. After all, the real value is determined by human needs. In a shortage of grain, crude or natural gas, even the piles of gold may have little value.

In this light, it is outright outrageous how the US Deputy National Security Adviser, Daleep Singh, warned the countries, trying to restore the disruptions to the world trade caused by West-imposed economic restrictions and thus prevent the global famine and economic collapse, that there would be “consequences [for] countries that actively attempt to circumvent or backfill” the “sanctions”. Although the adviser declined to elaborate on the nature of those “consequences”, their arsenal is roughly known (see Figure 1 again).

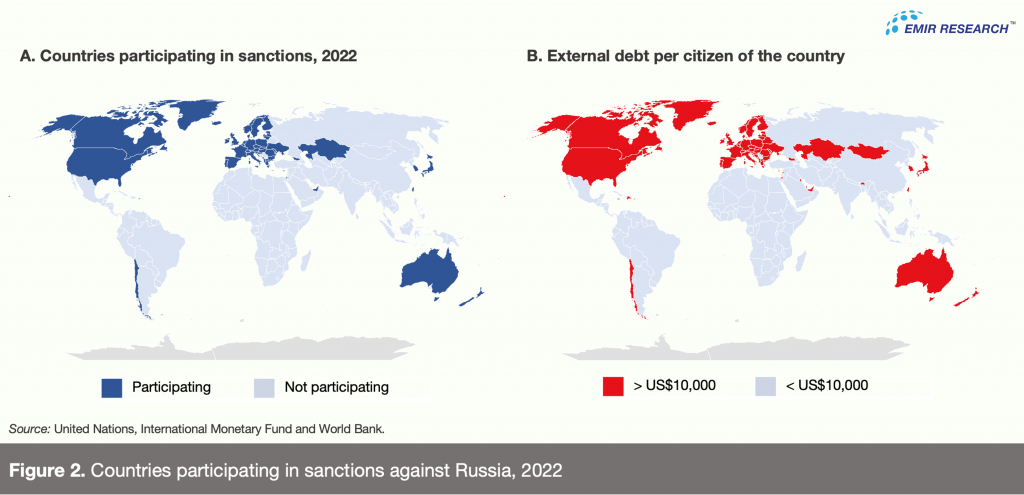

Perhaps, this is one of those decisive “either… or” (not “and… and”) moments in history when all the nations should come together like a bunch of arrows that are hard to break. The bully countries are a handful (Figure 2), and their “humanitarian stance” appears to be highly correlated with their ability to live beyond the country’s means. At the same time, their counterparts, who are the majority and who laboriously produce things of real value, in exchange, receive only electronic account entries that cost nothing and, as it became clear now, can be multiplied by zero at any time.

Although the immediacy of the US dollar and global credit system meltdown depends on how collectively intelligent and swift other nations are to learn from Russia’s experience and be proactive in up-stepping their sovereignty, the imminency of such an event has just become ever more apparent.

Dr Rais Hussin and Dr Margarita Peredaryenko are part of the research team at EMIR Research, an independent think tank focused on strategic policy recommendations based on rigorous research.