Published in AstroAwani, BusinessToda & DailyExpress, image by AstroAwani.

Malaysia has made an ambitious pledge to achieve “net-zero” carbon emissions by 2050 – 27 years from now.

To achieve net-zero, a country has to absorb as much carbon as it produces. Thus, the approach would be to ramp up on efforts to switch from carbon emitting energy sources, such as coal and natural gas, to renewable green energy whilst also promoting the sequestration of carbon.

However, despite 77% of Malaysia’s greenhouse gas emissions being absorbed by “carbon-sinks” such as forests and the seas as well oceans, Malaysia was still a net emitter of 57.8 million metric tons of carbon in 2021 or 23% of 251.6 million metric tons (“Cover Story: Charting a net-zero pathway for Malaysia”, The Edge Malaysia, May 19, 2022).

Theoretically, should Malaysia successfully transition its power sources to renewable green energy, on its own this would result in a cut of 72% of all carbon emissions (“Global Emissions”, Centre for Climate and Energy Solutions, 2020).

Hence, the transition from “brown energy” (polluting sources) to “green energy” (renewable sources) needs to be doubled down.

Existing Green Incentives

To date, the government has implemented the Net Energy Metering Scheme (NEM) and feed-in tariff (FiT) which are mechanisms that allow customers to either lower their electricity bill by exporting excess energy to TNB at prevailing displaced (i.e., average cost of generating and supplying one kilowatt hour of electricity from resources other than renewable resources) costs or to “sell” all generated energy to TNB’s grid.

Introduced in 2014, Malaysia also has tax allowances for green investment projects and assets (GITA), and green income tax exemption services (GITE). GITA is applicable for companies that 1) acquire qualifying green technology assets listed under the MyHIJAU Directory (containing information about all green products and services that have been recognised under the MyHIJAU Mark – which is a consolidation of regional and international green certifications) or 2) undertake qualifying green technology projects for business or own consumption.

GITE applies to green technology service provider companies that’re listed under the MyHIJAU Directory. These tax-incentives encourage general business investments into green technologies and support service providers.

Additionally, there’s also the Green Technology Financing Scheme 2.0 (GTFS) which are soft loans from the government in the sectors of energy, water, building and construction, transport, waste, and manufacturing. The financing size goes up to RM100 million per group of company for green technology producers.

Meanwhile, uses of green technology have a maximum financing size of RM50 million and energy service companies have RM23 million. For context, the start-up capital for solar farm projects requires on average 7 to 8 figures.

Current Situation

Despite the incentives above, Malaysia is still heavily reliant on brown energy sources and potentials in renewables remain untapped.

According to the BP (British Petroleum) 2020 Statistical Review of World Energy, petroleum and other liquids and natural gas are the primary energy sources consumed in Malaysia – with estimated shares of 37% and 36%, respectively. Coal meets about 21% of the country’s energy consumption.

According to the CEO of Energy Commission Abdul Razib Dawood, among the sectors, the industrial and transport sectors constituted 66.1% of the total energy consumption in 2019. This was followed by the non-energy sector (20.5%), commercial (7%), residential (5%) and agriculture sectors (1.4%).

Currently, renewable energy accounts for only 6% of total consumption.

Problems Faced by the Renewable Energy Sector

At current capacities, renewable energy is simply inadequate to meet the vast energy demands of the country. The following are hurdles in the way of renewable energy development in Malaysia:

- Insufficient foreign direct investment (FDI) into renewable energy

According to the Malaysian Investment Development Authority (MIDA), of the total investments into renewable energy in 2021, only 23.3% or RM0.7 billion came from foreign investments.

Compare this to RM29.5 billion of FDI into the manufacturing sector, for example.

What more is that Malaysia lags behind other Southeast Asian countries in renewable energy.

For example, in recent months, Indonesia and Vietnam have clinched impressive investment deals with developed nations to shutter coal-fired power plants early and reduce greenhouse gas emissions from their power sectors (“Malaysia lags on renewable energy, threatening climate goals”, Eco-Business, February 07, 2023).

However, as warned by Peter Godfrey, Managing Director for Asia Pacific at the Energy Institute in Singapore, “Malaysia’s abundant natural gas supplies mean there is little urgency to meet renewable energy targets … underlining the importance of efforts to reduce emissions from the natural gas industry”.

- Green Skills Talent-Gap

There’s a global shortage in the talent, skills and jobs to deliver the transition to a green economy (“Mind the ESG skills gap: Asia’s workforce is greening too slowly”, Eco-Business, April 20, 2022).

This is because of high industrial demand for individuals with green knowledge and skills, particularly in waste management, energy sustainability, city planning and design, etc. (“Green Skills for Green Industry: A Review of Literature”, Lai C.S., Journal of Physics: Conference Series, Vol. 1019, 2017).

Nevertheless, the prevalence of sustainability-related courses and exposure to green issues at primary, secondary, and tertiary education levels in Malaysia remains insufficient.

- Difficulty in Market Penetration

The presence of established players in coal and natural gas which dominate the energy market can be a hindrance to the rapid emergence as well as growth of the renewable energy sector.

From Foes to Friends

In order to meet our 2050 net-zero goals, merely minimising the hurdles in the way of renewable energy growth will not be enough.

The approach that’s now needed is the proactive fast-tracking of the renewable energy sector by bolstering its development and adoption rate.

However, it seems as though there’s a “tug-of-war” between brown energy and green energy – whereby the existence of the oil and gas (O&G) industry (as providing the resources for power generation in also constraining TNB’s transition and switch to renewables) comes at an opportunity cost vis-à-vis the renewable energy sector.

This reflects the scenario of a zero-sum game where a gain by one party is equivalent to the other’s loss.

What if we played a different game – a positive-sum game where both brown and green energy companies “win” and get bigger “shares of the pie”.

The solution is nothing short of the indispensable case for a strategic synergy and alliance – i.e., the shaking of hands between O&G and the renewable energy sectors.

How’s it Going for O&G?

With the objective of reducing emissions, the imposition of carbon taxes levied on coal, oil products, and natural gas in proportion to their carbon contents is increasing in many parts of the world.

This adds cost and pressures on the high-polluting O&G industry.

Another system that’s gaining credence is the issuance of carbon credits (carbon offset).

These are permits to allow a polluter to emit a certain amount of greenhouse gases (GHGs). Emissions could also be offsetted by undertaking sustainable projects to compensate for the emissions they generate elsewhere.

These carbon credits are often traded in voluntary carbon markets (VCMs). Carbon credits also contribute to the environmental aspect of the ESG framework ratings which assess how companies perform in environmental, social, and governance issues.

As more and more investors evaluate company performance based on their ESG rankings, this has been a driver for the O&G industry to contribute to the research and development (R&D) as well as creation of green energy. Thus, in effect, O&G has already been one of the key supporters for the development of and investment into renewables.

That said, widespread adoption and integration of renewable energy remains nascent (“The role of renewables within upstream oil and gas is gaining significant momentum”, Global Data Energy, April 1, 2021).

Upstream O&G activities such as exploration, drilling and extraction of crude oil and natural gas require a great deal of energy and also produce a great deal of GHGs during operational leakages, combustion, and gas flaring.

Opportunity for Mutual Gains

The low hanging fruit for both renewable energy and the O&G industry is in eliminating routine flaring, minimising methane emissions through enhanced leak detection and repair (LDAR) and using wind and solar to electrify O&G production operations. This would enable O&G companies to radically reduce their emissions whilst directly supporting the renewable energy industry.

In the context of Malaysia, the Malaysian Green Technology and Climate Change Corporation (MGTC) – an agency under the Ministry of Natural Resources, Environment and Climate Change (NRECC) – could be at the forefront of facilitating a conducive and supportive business environment for such a horizontal partnership.

The Ministry of Science, Technology, and Innovation (MOSTI) could also take this horizontal partnership a step further by leveraging existing O&G infrastructures to be repurposed – primarily to support the development of the renewable energy sector. For context, the O&G industry installs major offshore infrastructure to extract fossil fuels.

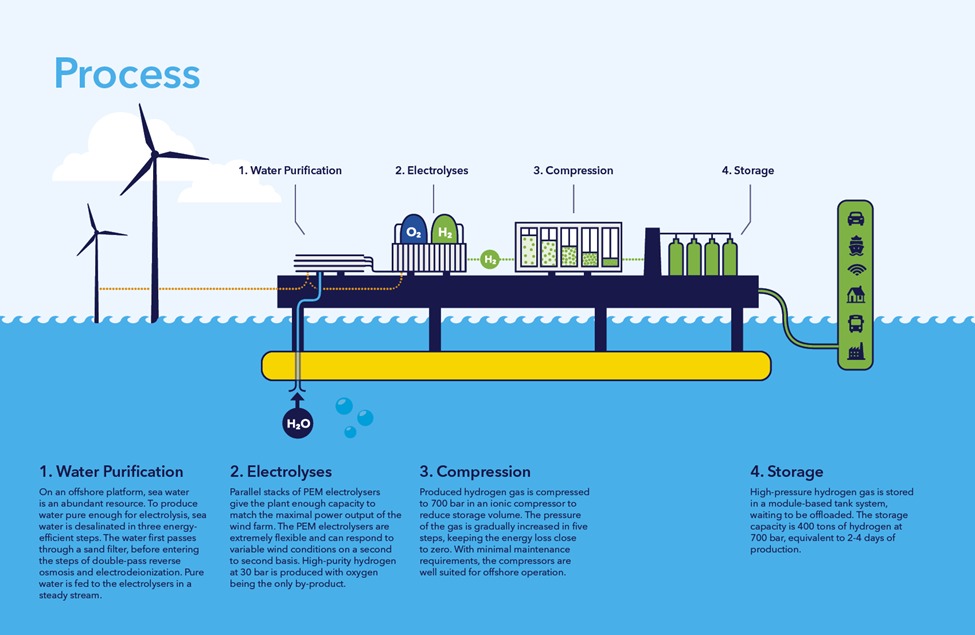

At the end-of-life stage, these infrastructures have to be removed and disposed of – accruing high costs. An alternative route then could be to repurpose these pipelines to transport (green) hydrogen produced at sea back to shore (refer to diagram below on how hydrogen is produced at sea via hydrolysis).

The re-purposing includes transporting renewable energy from offshore wind sites in the form of molecules – converting the electricity produced into hydrogen which are then channelled via the repurposed pipelines.

Diagram

Source: “A new era for hydrogen energy unveiled by students at DNV GL”, Windpower, (August 14, 2015).

Experience in offshore infrastructure from the O&G industry will be highly beneficial in offshore wind, whether it’s in foundations/structures, project management, vessel operations, working with moving cables, seabed survey/investigation, or balance of plant (BoP) operations and maintenance (O&M). Transferable assets and skills are also available in the petroleum support/services sector such as the supply of tugs, mooring systems, heavy lifting boats, and wiring.

Since floating wind turbines require a set of technical expertise that many offshore wind companies lack, this may prove to be a promising point of synergy between O&G and renewable energy (“The opportunities for collaboration and synergy between the UK offshore oil & gas and wind sectors”, Westwood Global Energy Group, November 11, 2020). In this aspect, the MGTC could also act to facilitate knowledge transfer and sharing between the O&G industry with the renewable energy sector.

Lastly, another potential point for brown and green energy collaboration lies in the process of capturing and storing carbon dioxide, also known as the process of carbon sequestration. Various technologies are now available for carbon capture and storage (CCS).

Beyond tax-incentives for the O&G industry to install these CCS technologies and to fund reforestation projects, captured carbon could also be utilised for growing algae to be used for biofuel.

Besides being a renewable option, algae also yield more biofuel per acre than plant-based biofuels (“Using Microorganisms to Turn CO2 into Fuel”, News Medical Net, March 08, 2022).

In summary, some of the practical and specific outcomes from the brown-green energy synergy would be:

1) incentivising CCS;

2) integrated supply for algae biofuel; and

3) replacing plants with algae in biofuel generation and thus freeing up more land for reforestation.

Spearheading renewable energy development in Malaysia requires a re-envisioning/re-conceptualising/re-framing of the relationship between green and brown energy sources into strategic partnership/alliance, moving forward.

Jason Loh and Jennifer Ley Ho Ying are part of the research team at EMIR Research, an independent think tank focused on strategic policy recommendations based on rigorous research.