Published in Astro Awani, Malaysiakini, Malay Mail, The Star, Malaysia Now, Focus Malaysia, Business Today & The Star, image by Astro Awani.

EMIR Research would like to refer to our “Exit Strategy Building Blocks for Malaysia – Part 1” where under goal number two of extending social and business safety nets, the first objective is loan moratorium for all micro, small and medium enterprises (MSMEs), B40 as well as M40 households while targeted for other individuals for at least three (3) months or 50% loan payment reduction for six (6) months. However, the overwhelming uptake and benefit to the many in the backdrop of a potentially grave economic outlook suggest this to be extended to six months of automatic blanket loan moratorium.

The aim is to provide a safety net to those at risk due to the shutting down of economic activities and prolonged unemployment.

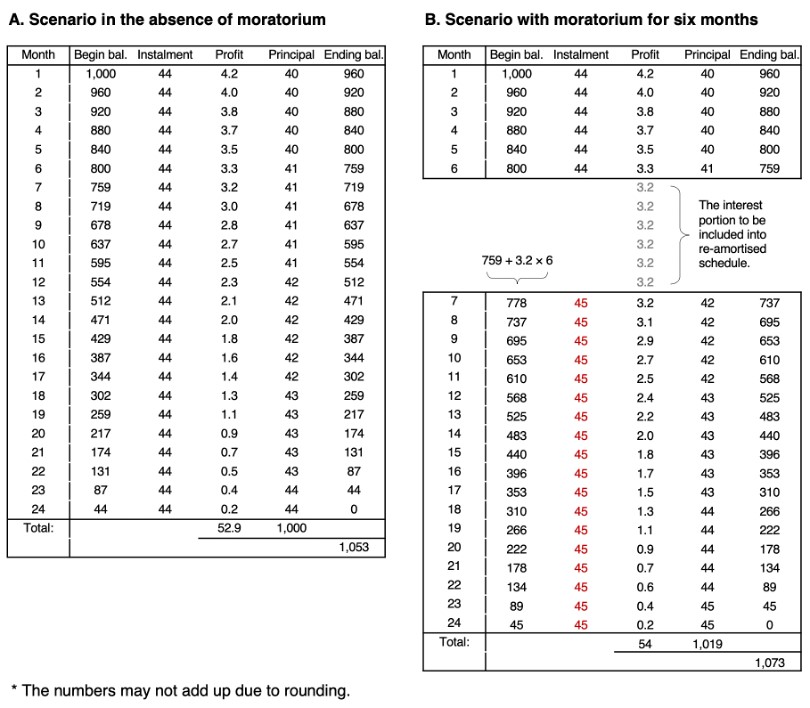

It is worth mentioning, a real moratorium that assists borrowers should have no roomfor the practice of charging borrowers an additional interest for the period of moratorium by re-amortising the loan payment schedule once the moratorium period is over.Under this practice, the total interest portion collection (profit) of which banks forego during the moratorium periodis added to the beginning balance and thus result in a monthly instalment amount higher than the pre-moratorium one (Figure 1).

It has to be re-emphasised that the borrowers have not defaulted on their payments—the payments were merely postponed—and,provided the borrowers resume and finish all the payments according to the schedule, banks would not lose their real profits.

Although, banks would report some mere accounting losses (“day one” modification losses) due to re-evaluation of their outstanding loans. Under the International Financial Reporting Standards (IFRS 9), the banks have to show the fair value of the loans in their books based on the present value (PV) formula. Therefore, the fair value of the outstanding loans will reduce due to the newly extended period by the moratorium.

Also, banks would lose in terms of PV by postponing their collections to a later period. Receiving the repayment later than initially scheduled could affect the banks’ capital adequacy ratio whereby it has to increase its provisioning for possible loan default – which represents an opportunity cost to the bank. In 2019, loan loss coverage stood at 90%, and in 2020 this increased to 140%. However, this doesn’t in any way affect profits, as we shall see later.

Notwithstanding, the opportunity cost for banks under the current situation is limited in any case. That is to say, there may not be enough credit-worthy customers out there that would qualify under the banks’ stringent requirements for new loans, anyway. This would have boosted overall spending by way of the multiplier effect and circulation of cash in the economy (both businesses and households).

Instead, in the aftermath of the loan moratorium, banks lent out to purchase residential properties and passenger vehicles with the various tax incentives offered by the government. But the impact of such purchases has been limited—the loans which create the deposits are then not withdrawn for additional spending (and hence, the multiplier effect in terms of overall cash circulation).

Furthermore, it was in tandem with a steep decline in credit card loans which strongly points to a drop in overall spending activity during the pandemic, according to the June 2021 edition of the Malaysia Economic Monitor of the World Bank.

According to Bank Negara Governor, Nor Shamsiah Mohd Yunus, banks lent out RM206.2 billion in the fourth quarter of 2020, which exceeds the 2017-2019 quarterly average of RM196.7 billion. In the previous third quarter, the value of business loan disbursements stood lower at RM182.4bil. This indicates that banks’ lending activities, although affected by the loan moratorium but marginally.

Under the “Lockdown MCO 3.0 – Survive to restart package” published on May 29, we have explained when observing the income statements of major banks in Malaysia, that for some banks, net interest income does not seem to be a big profit contributor. Furthermore, lower interest income recorded has also been offset by lower interest expense – the costs of funds for the banks have also generally reduced in line with the lower interest rate environment.

Most importantly, we observe that once the moratorium has ended, based on the financial standing in Q1 2021, the ease of recovery for the banks was evident. If we examine net profits for Q1 2021 at the group level, we can observe examples of healthy profits from Maybank (RM 2.43 billion), Hong Leong Bank (RM 772 million), and RHB (RM 651 million). Keep in mind that these figures were still generated within the time where almost all borrowers took up the opt-in moratorium.

However, let’s now look at the other side of the coin as extensive focus on banks’ profits is duly uncalled for when many in the real economystraggle to protect the principle. It has full moral ground for the banking sector that has placed itself as a risk-free sector(including Islamic) to finally accept some reduced profits (not losses) and share the burden of the pandemic with the rakyat.

A relative reduction in profits to the banks attributable to the moratoriums is incomparable to the relative socio-economic harm to the people in the absence of a moratorium, especially during lockdowns.

The danger of massive loan defaults if the moratorium is not granted might be more real than we think.

Malaysia public indebtedness is at its historic high while the ability to service it is stretched unprecedentedly thin by the pandemic.

According to Bank Negara Malaysia (BNM), our household debt is at 93.3% as of December 2020, from the previous record high of 87.5% in June 2020. It’s second-highest in Asia after South Korea (but trails several high-income countries that exceed the 100% level, such as Australia, Switzerland, Denmark, Norway and Canada).

Even in the absence of the unprecedented pandemic crisis, this high level of indebtedness on the national scale should raise great concern.

The President of SME Association of Malaysia (SMEAM), Datuk Michael Kang, was reported to have projected a minimum of 40% of SMEs to shut down with the full-scale Movement Control Order (MCO), followed by many more job losses in the next few months. He stressed the urgent need for an automatic moratorium of at least six months to relieve the cash flow burdens of these businesses.

SMEAM Vice President Chin Chee Seong reportedly pointed out that at least 50,000 SMEs could go bust if MCO 3.0 is extended. And the extension is probable, if not necessary, given the unclear indicators of virus transmission control at present.

Chin was also reported to mention that according to the SMEAM’s survey, “only 8.6% of the SMEs said business is as usual, but the remaining 91.4% indicated that they will suffer losses from 25% to 100%”.

It’s best to note loan defaults only require disruption in cash flows and not have to wait for business closures.

Given that almost all businesses in Malaysia are SMEs (98.5% of all businesses) and provide a large chunk of employment, these figures indicate potentially devastating outcomes that would implicate the banks and not just these businesses and individuals.

In the fractional reserve and interest rate-based system, default is not a possibility but the certainty by the system design. The total extended loans cannot be repaid in aggregate simply because the interest payable does not exist in the money form. So, it is like a nationwide musical chair game—someone has to default. The question only is “who” and “when”?

To answer “who”, we know those are the B40s, low M40, and MSMEs. But, worrying enough, they are increasingly becoming the majority. According to the Economic Action Council (EAC) secretariat, more than 600,000 households from the middle 40% (M40) income group have slipped into the bottom 40% (B40) category.

While answering “when”, we would certainly like the answer to be distant and randomly distributed in time. The banking model works well as long as one person’s default is independent of other people defaulting.

However, the Covid-19 pandemic is the type of event that changes the probability of default for all borrowers simultaneously! And pushing them ruthlessly to pay loans now when their cash inflows are dwindling or halting will hasten the reckoning by this black swan event.

This will have drastic consequences not only for the banks but for the entire economy with the vicious cycles of more defaults, retrenchments and closures. The liquidity shortage will add to our already insurmountable mount of fighting the Covid-19 pandemic. As banks will be shaken to the core so will those who own a significant share of their profits – Khazanah, Employees Provident Fund (EPF), Tabung Haji to name just a few.

Is it not then far better to provide both parties, i.e., banks (lenders) and households and businesses (borrowers) with the “breathing space” now by extending the automatic moratorium for all?

However, some may still insist that not everybody needs an automatic loan moratorium.

Datuk Michael Kang was reported to mention that 90 per cent of SMEAM’s 15,000 members have taken advantage of the opt-in loan moratorium offered after the first six-month moratorium that ended on Sept 30, 2021. This indicates not only was the first automatic loan moratorium a welcome reprieve, but almost all felt the need to opt-in for the next round of moratorium – without which could have resulted in significant personal and business loans defaults.

The Finance Minister also reported that after the automatic loan moratorium ended in September 2020, 85% of borrowers resumed repayments.

Another way to look at this is that 85% of borrowers were able to resume payment precisely because loan moratoriums helped them keep their incomes by easing the cash flows of businesses. In the absence of moratorium, or focusing only on the 15% defaulters means the total number of defaulters may increase anywhere between 15% to 85%. The 15% figure means 15% of borrowers are in a bad enough position that not even moratoriums could help them survive. If anything, they need more assistance.

On the other note, 85% and 15% are all only the dry numbers. So could it be that the 85% have cash flow difficulties too? It’s just that the difference between 85% and 15% is the period (or inter-temporal capacity) over which the cash flow can last. That is, for the 85%, it’s only the case that their cash flow can stretch over a slightly longer period.

Has anyone asked what it would take for the 85% to resume their payments? Maybe they had to go to a pawn shop, or withdraw EPF savings, or go to loan sharks, or sell some of their assets or do other things detrimental to their wellbeing and human dignity. And did anyone even wonder how bad is the situation of those 15% who could not resume and what happened to them afterwards?

The blanket moratorium is not only direly needed but faster and easier to implement.

Extending the blanket moratorium will allow us to extend the safety net wide enough to capture all those in dire need, including the informal economic sector. And if this wide safety net captures few “free rides” (those who do not need moratorium but enjoy benefits of it), then let it be – we know those are very few compared to the majority who suffer.

We have seen how the previous moratoriums helped individuals and businesses stay afloat. These people were then able to resume repayments, and banks showed a healthy recovery thereafter. This win-win scenario is needed now more than ever.

Maybe for once, at least under the unprecedented circumstances threatening us all as a nation, the notorious value of profit as the be-all and end-all could give way to the universal value of life – the value of our life and lives of others.

Dr Rais Hussin, Dr Margarita Peredaryenko, Jason Loh & Ameen Kamal are part of the research team of EMIR Research, an independent think tank focused on strategic policy recommendations based on rigorous research.

Diterbitkan di Malaysia Now.

Emir Research mencadangkan kerajaan mengumumkan moratorium pinjaman automatik, mengatakan ia adalah ‘situasi menang-menang’ walaupun beberapa peminjam kaya turut ‘menikmatinya’.

Moratorium pinjaman automatik dari bank sangat kritikal ketika ini bagi membantu individu dan perniagaan kecil terus bertahan daripada impak penutupan perniagaan mereka yang berterusan, kata sebuah badan penyelidikan bebas selepas kerajaan hari ini mengumumkan perintah kawalan pergerakan (PKP) dilanjutkan sekali lagi.

“Bahaya kegagalan membayar semula pinjaman secara besar-besaran jika moratorium tidak diberikan mungkin lebih besar daripada yang kita fikirkan,” kata Emir Research dengan alasan moratorium pinjaman menyeluruh adalah serupa dengan skim yang sama diumumkan kerajaan tahun lalu.

Badan pemikir itu juga tidak bersetuju dengan Menteri Kewangan Tengku Zafrul Aziz yang berkata kebanyakan peminjam kembali berada dalam keadaan kewangan yang stabil berdasarkan fakta bahawa 85% daripadanya kembali membayar pinjaman dan tidak memilih untuk melanjutkan moratorium enam bulan ketika berakhir pada September tahun lalu.

Emir Research juga menjelaskan punca “sebenarnya adalah kerana moratorium pinjaman membantu mereka menyimpan pendapatan” dan kerana itu, kebanyakan peminjam dapat meneruskan pembayaran.

“Sekiranya tidak ada moratorium, atau hanya tumpu kepada 15% orang yang gagal bayar bermaksud jumlah peminjam tidak membayar boleh meningkat antara 15% hingga 85%.

“Angka 15% itu bermaksud 15% peminjam berada dalam kedudukan yang cukup buruk sehingga moratorium pun tidak dapat menolong mereka untuk bertahan. Sebaliknya, mereka memerlukan lebih banyak bantuan,” kata badan pemikir itu dalam artikel yang menjelaskan mengapa moratorium automatik mesti diumumkan.

Lockdown yang dilaksanakan awal bulan ini menyaksikan hampir seluruh sektor perniagaan ditutup bagi membendung Covid-19.

Putrajaya berkata bank akan memberikan moratorium selama tiga bulan dengan permohonan mereka yang berada dalam kumpulan B40 selain yang kehilangan pendapatan akibat pandemik.

Langkah terbaru yang diambil kerajaan itu berbeza daripada moratorium automatik seperti yang diumumkan semasa PKP tahun lalu apabila kerajaan melaksanakan pembekuan pembayaran semula pinjaman selama enam bulan.

Zafrul mempertahankan keputusan kerajaan yang tidak mahu mengarahkan bank-bank untuk menyediakan bantuan serupa seperti tahun lalu, mengatakan kebanyakan peminjam berada pada tahap yang lebih baik untuk membayar semula pinjaman berbanding tahun lalu.

Langkah tersebut turut mencetuskan perbahasan berhubung kuasa menteri kewangan ke atas bank, selain beliau turut dikritik kerana cenderung menyebelahi industri bank.

Namun baru-baru ini, Zafrul memberikan isyarat kerajaan akan mempertimbangkan semula keputusan untuk melaksanakan moratorium automatik, mengatakan beliau sudah membincangkan perkara itu dengan perdana menteri dan agensi-agensi yang relevan.

Semalam, Zafrul turut berkata kerajaan akan mengumumkan bantuan bersesuaian pada masa terdekat.

Emir Research berkata sukar untuk mengenal pasti mengapa ramai yang memilih untuk tidak melanjutkan moratorium pinjaman mereka selepas tempoh enam bulan tahun lalu.

“Apakah mungkin mereka yang 85% itu memiliki masalah aliran tunai juga? Perbezaan antara 85% dan 15% adalah tempoh (atau kapasiti ‘inter-temporal’) di mana aliran tunai mereka boleh terus kekal mengalir.

“Golongan 85% itu memiliki aliran tunai yang boleh dipanjangkan ke tempoh yang lebih lama,” katanya dalam artikel yang ditulis Ketua Pengarah Eksekutif Emir Research Rais Hussin dan pengkaji lain termasuk Margarita Peredaryenko, Jason Loh dan Ameen Kamal.

“Apakah ada sesiapa yang tanya apa yang golongan 85% itu lakukan untuk kembali bayar pinjaman mereka?

“Mungkin mereka pergi ke kedai pajak gadai, keluarkan simpanan KWSP, atau pinjam daripada peminjam haram, atau jual aset-aset mereka atau lakukan perkara-perkara yang melanggar tatasusila dan maruah.

“Dan adakah sesiapa yang fikir betapa buruknya situasi golongan 15% itu yang tak mampu membayar semula pinjaman dan apa yang berlaku pada mereka selepas itu?” tambah mereka.

Mereka berkata moratorium pinjaman automatik bukan hanya sangat diperlukan ketika ini “bahkan perlu lebih segera dan mudah dilaksanakan”, kerana ia dapat membina jaringan keselamatan “yang lebar bagi membantu mereka yang sangat-sangat memerlukan, termasuk sektor ekonomi tidak formal”.

“Dan jika jaringan ini turut menarik mereka yang ‘naik percuma’ (iaitu mereka yang tidak memerlukan skim moratorium namun mendapat manfaatnya), biarkan saja – kerana kami tahu golongan itu terlalu sedikit berbanding majoriti yang menderita,” kata Emir Research sambil menyifatkan moratorium itu kini boleh dikatakan berada pada tahap “situasi menang-menang”.

“Mungkin untuk sekali ini, sekurang-kurangnya dalam berdepan keadaan yang belum pernah terjadi sebelum ini dan mengancam kita semua sebagai sebuah negara, nilai keuntungan yang biasa dilihat sebagai segala-galanya akan memberi tempat yang layak kepada nilai universal kehidupan – nilai kehidupan kita dan kehidupan orang lain.”

Dr Rais Hussin, Dr Margarita Peredaryenko, Jason Loh dan Ameen Kamal adalah sebahagian daripada pasukan penyelidik di EMIR Research, sebuah organisasi pemikir bebas berfokuskan saranan-saranan dasar strategik berdasarkan kajian yang menyeluruh.

刊登于光明日报

埃米爾研究機構(Emir Research)認為,我國不僅有必要實施全面性暫緩還貸,且應更快和更便捷的實施暫緩還貸措施。

埃米爾研究機構今日發表文告指出,延長全面性的暫緩還貸令將能夠擴大安全網的范圍,以涵蓋所有急需援助的群體,包括非正規經濟部門。

該機構表示,即便擴大全面性的暫緩還貸措施,可能會導致那些非必要人士也能“搭便車”享受暫緩還貸的好處,但那也無所謂。

“我們知道,與大多數受苦的人相比,這些人很少。”

埃米爾研究機構表示,暫緩還貸的目的是為那些因經濟活動關閉和長期失業,而出現危機的人提供安全網。

“值得一提的是,真正幫助借款人的暫緩還貸,不應該在暫緩還貸期結束後通過重新攤銷貸款支付時間表,向借款人收取延期償付期的額外利息,從而導致每月分期付款金額高於暫停前的一期。”

埃米爾研究機構強調,借款人並沒有拖欠還款,只是延期還款而已,只要借款人按期恢復並完成所有還款,銀行就不會損失實際利潤。

“盡管如此,由於重新評估其未償還貸款,銀行會報告一些純粹的會計損失。根據國際財務報告准則 (IFRS 9),銀行必須根據現值 (PV) 公式在其賬簿中顯示貸款的公允價值,因此未償還貸款的公允價值將因暫停延期而新延長。”

“此外,銀行會因將收款推遲到後期而損失 PV。遲於最初計劃收到還款可能會影響銀行的資本充足率,因此銀行必須增加為可能的貸款違約准備的准備金——這對銀行來說是一種機會成本。 ”

埃米爾研究機構表示,盡管銀行在2019年的貸款損失覆蓋率為 90%,2020年增加到 140%,但這依舊不會以任何方式影響利潤。

埃米爾研究機構引述國行總裁拿督諾珊霞的談話表示,銀行在2020年第四季度放出了 2062億令吉的貸款,超過了2017至2019年季度的平均1967億令吉,而在前三個季度,商業貸款支出的價值較低,為1824億令吉。

銀行貸款活動影響幅度不大

“這表明銀行的貸款活動雖然受到暫緩還貸的影響但幅度不大。”

“最重要的是,我們觀察到2021年第一季度的財務狀況,馬來亞銀行(24.3億令吉)、豐隆銀行(7.72億令吉)和興業銀行(6.51億令吉)依舊有健康的利潤。”

“請記住,這些數字然是在幾乎所有借款人都獲得暫緩還貸的期限內產生的。”

埃米爾研究機構指出,由於受到疫情的影響,馬來西亞公共債務處於歷史高位,而償還債務的能力則空前薄弱。

“如果不批准暫緩還貸,大規模貸款違約,可能比我們想像的更嚴重。”

“根據國家銀行(BNM)的數據,截至2020年12月,我們的家庭債務為93.3%,高於2020 年6月創下的87.5%的歷史新高,這是亞洲僅次於韓國的第二高。”

“即使沒有史無前例的疫情危機,這種高水平的國家債務也應該引起人們的高度關注。”

埃米爾研究機構透露,鑑於馬來西亞幾乎所有企業都是中小企業(占所有企業的 98.5%)並提供大量就業機會,這些數字表明潛在的毀滅性後果將牽連銀行,而不僅僅是這些企業和個人。

“在他們的現金流入減少或停止時,現在就無情地催促他們償還貸款,將加速引起市場連鎖負面反應,這將不僅對銀行而且對整個經濟產生嚴重後果,出現更多違約、裁員和關閉的惡性循環。”

“由於銀行的核心受到動搖,那些擁有大量利潤的機構——國庫控股、雇員公積金局(EPF)、朝聖基金會等等也將受到影響。”

“現在通過延長對所有人的自動暫緩還貸,為雙方,即銀行(貸方)和家庭和企業(借款人)提供‘喘息空間’不是更好嗎?”

埃米爾研究機構強調,我國在第一階段行動管制令期間實施的暫緩還貸措施,已成功幫助個人和企業維持生計。

“這些人隨後能夠恢復還款,而銀行也顯示出健康的復甦,因此現在比以往任何時候都更需要這種雙贏的方案。”

“也許這一次,至少在威脅我們整個國家的前所未有的情況下,臭名昭著的利潤作為一切和最終的價值,可以讓位於生命的普世價值——我們生命和他人生命的價值。”